6.25 tax calculator

The final price including tax 725 054 779. 1 00625 10625.

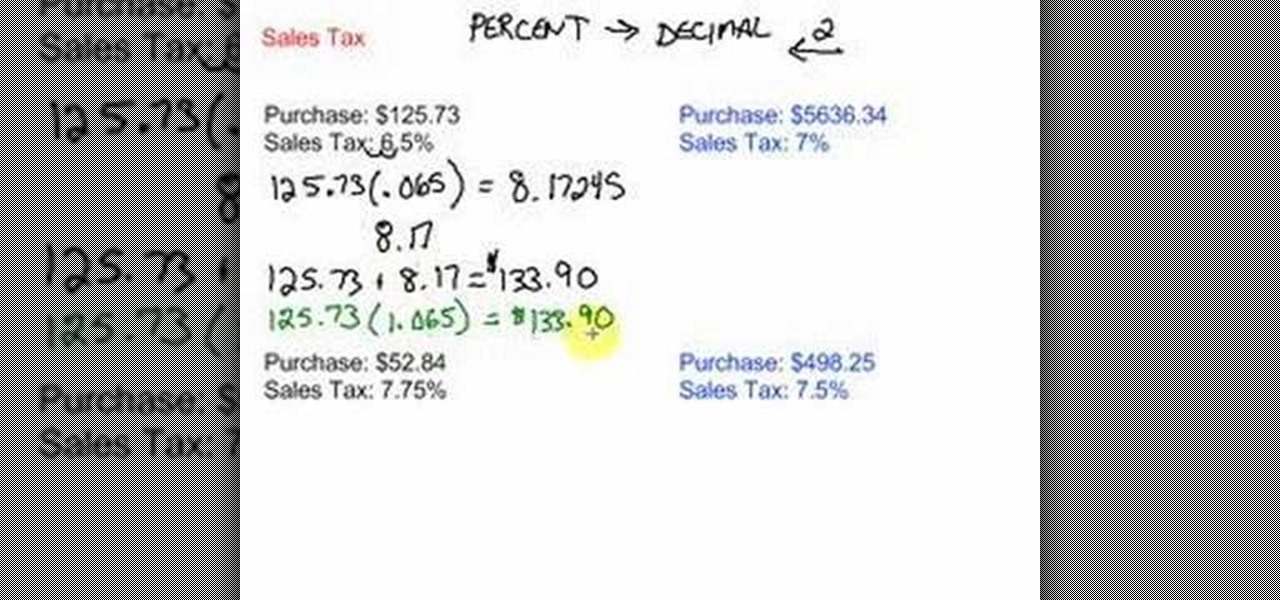

How To Figure Out And Calculate Sales Tax Math Wonderhowto

So divide 625 by 100 to get 00625.

. Texas has 2176 special sales tax jurisdictions with local. The Tax Value. 625 Tax Rate Ohios Tax Collection Schedule Sales and Use Tax for State County andor Transit Tax.

A tax of 625 percent was added to the product to make it equal to 53125. List price is 90 and tax percentage is 65. Tax 130 00625 tax 8125.

Divide tax percentage by 100. You will pay 455 in tax on a 70 item. Divide the percentage added to the original by 100.

53125 10625 500. Tax 725 0075. Add one to the percentage.

65 100 0065. You know that the tax rate at your state is 625. Firstly if the tax is expressed in percent divide the tax rate by 100.

So divide 625 by 100 to get 00625. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. Add one to the percentage expressed as a decimal. Add one to the percentage.

Speak with a lender and get several quotes to find the best rates. A tax of 625 percent was added to the product to make it equal to 53125. You know that the tax rate at your state is 625.

Ad Calculate your tax refund and file your federal taxes for free. Whats the payment on a 625 loan. Firstly if the tax is expressed in percent divide the tax rate by 100.

So divide 625 by 100 to get 00625. 70 0065 455. The buyer pays the sales tax as an addition to the purchase price to the vendor at the time of purchase.

This is the price excluding taxes. You can do this by simply moving the decimal point two spaces to the left. Groceries prescription drugs and non-prescription drugs are exempt from the Texas sales tax.

A tax of 75 percent was added to the product to make it equal to 1101875. The price of the coffee maker is 70 and your state sales tax is 65. The statewide sales tax rate of 625 is among the 20 lowest in the country when including the local taxes collected in many other states.

Texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of 625 percent on the purchase price or standard presumptive value SPV whichever is the highest value. 1 00625 10625. Type the loan amount interest rates and length into the calculator.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. A Before Tax Price Divide the tax rate by 100. The most significant taxes in Massachusetts are the sales and income taxes both of which consist of a flat rate paid by residents statewide.

First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as contributions to your 401k. Tax 40 00625 tax 25. Now find the tax value by multiplying tax rate by the item value.

Divide the final amount by the value above to find the original amount before the tax was added. You can fully customize this tax table for any sales tax rate price increment or starting price - just enter your parameters in the form below. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax.

The Texas state sales tax rate is 625 and the average TX sales tax after local surtaxes is 805. Now find the tax value by multiplying tax rate by the before tax price. So divide 75 by 100 to get 0075.

In this example we do 625100 00625 Now find the tax value by multiplying tax rate by the item value. What is the tax value. Tax 054 tax value rouded to 2 decimals Add tax to the before tax price to get the final price.

SPV applies wherever you buy the vehicle in Texas or out of state. A typical mortgage is 30 years but this calculator can be used for any loan such as a car loan often 3 4 or 5 years business land contract etc. How much is the before tax price.

A tax of 625 percent was added to the product to make it equal to 63750. In this example we do 625100 00625 Now find the tax value by multiplying tax rate by the item value. Divide the final amount by the value above to find the original amount before the tax was added.

Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 825. You can look up applicable sales tax rates in your area with our sales tax calculator. You can fully customize this tax table for any sales tax rate price increment or.

Add tax to list price to get total price. The Massachusetts sales tax is 625 of the sales price or rental charge of tangible personal property including gas electricity and steam and telecommunications services 1 sold or rented in Massachusetts. How Income Taxes Are Calculated.

Tax Rate Starting Price Price Increment 625 Sales Tax Table - Prices from 79660 to 84340. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. 1 0075 1075.

Here a sales tax of 625 percent was added to the bill to make it 1051875. Multiply price by decimal tax rate. 70 455 7455.

Add one to the percentage. You can do this by simply moving the decimal point two spaces to the left. The Massachusetts income tax rate is 500.

Reverse Sales Tax Calculator

Gay Pride Rainbow Ombre Hearts Small Project Bag Support Lgbtq Knitting Project Bag Zipper Travel Bag Clutch Crochet Bag Yarn Tote Sd40

Bazic Pocket Size Calculator 8 Digit Flip Cover Lcd Display 1 Pack Walmart Com

6 25 Sales Tax Calculator Template

How To Figure Out And Calculate Sales Tax Math Wonderhowto

Bazic Scientific Calculator 240 Function W Slide On Case Bazicstore

Pin Em Products

Lottery Tax Calculator

Sales Tax Calculator

Tip Sales Tax Calculator Salecalc Com

How To Calculate Tax Title And License In Texas Calculating Taxes On Newly Bought Cars

Texas Sales Tax Calculator Reverse Sales Dremployee

Dated 12 Month Appointment Book Start Any Month 3 Sizes W Optional Income Expenses Daisy On Rustic Wood Design

Zejbl4dhhmst2m

Sales Tax Calculator

Us Sales Tax Calculator Reverse Sales Dremployee

Bazic Scientific Calculator 56 Function W Slide On Case Bazicstore